The TRATON GROUP recently announced its results for the first half of 2023. In the first six months of the year, TRATON sold a total of 168,114 vehicles, an increase of 22% compared to the same period in 2022. As a result, sales revenue increased by 27% to €22.9 billion from €18.0 billion in the first half of the previous year. An adjusted operating return on sales of 8.6% is putting the Company within reach of its 9% target for 2024.

So, what led to these successful results in the TRATON GROUP, which includes the Scania, MAN, Navistar, and Volkswagen Truck & Bus (VWTB) brands?

A range of factors are improving the Company’s profitability

Numerous factors had a positive impact on the Company’s performance during the first six months of 2023. The supply chain situation continued to improve, especially in Europe, which made higher production volumes possible and therefore improved the absorption of fixed costs.

Scania delivered a strong result in the first half of the year, with an adjusted operating return on sales of 13.4%. This is equivalent to a year-on-year improvement of more than five percentage points. MAN recorded an adjusted operating return on sales of 6.8%. In the second quarter in particular, it significantly improved its operating return on sales to 7.7%. The implementation of the company’s restructuring program is now in its final stages, and this is already having a positive impact on results. The expansion of the Krakow plant was successfully completed in May. Production will be ramped up to 300 vehicles and driver cabs per day by the end of 2023, three times more than the site’s previous capacity. This means that around two-thirds of all trucks and truck cabs in the entire MAN portfolio will be produced in Poland in the future. Navistar generated an operating return on sales of 6.2% (up 2.8 percentage points year-on-year).

The introduction of the new, more stringent PROCONVE P-8 emissions standard in Brazil led to a drop in overall customer demand in South America. This also resulted in a correspondingly sharp decline in the unit sales of trucks at TRATON’s Volkswagen Truck & Bus brand. Nevertheless, VWTB achieved an operating return on sales of 9.3% in the first six months of 2023, which was only slightly below that of the first half of 2022.

All in all, the TRATON GROUP’s strong performance was attributable to a range of factors: at Scania, these mainly included good sales figures and positive developments in the Vehicle Services business, the market and product mix, and unit price realization. These same factors, with the exception of the market and product mix, were also relevant to MAN’s results; while the same was true for Navistar, minus the Vehicle Services business. Unit price realization and product positioning were the main factors driving performance at Volkswagen Truck & Bus. At the same time, higher material, raw material, and energy prices and the increase in inflation worldwide had a negative impact across all of the TRATON GROUP’s brands.

TRATON continues to restrict the acceptance of new orders

Despite continued robust demand, especially in Europe and North America, the TRATON GROUP recorded a decline in incoming orders in the first six months of 2023. The Company’s book-to-bill ratio was 0.7, meaning that its unit sales were higher than its incoming orders. The backlog, while declining, remains at a very high level, and customer wait times are correspondingly long. As a result, TRATON’s brands continued to exercise caution in accepting new orders. Navistar, in particular, was very selective in its order acceptance. While the company’s production for 2023 is nearly sold out, its order books for 2024 will only be fully opened during the third quarter of this year.

TRATON’s Vehicle Services business and Financial Services continue to grow

TRATON was also able to expand its Vehicle Services business in the first six months of 2023. This area includes the spare parts business, services, and solutions, all of which enable a continuous stream of income that is less dependent on fluctuations in vehicle sales and market conditions.

Overall, the Company’s Vehicle Services business continued to grow in the first half of 2023. With sales revenue of €2.2 billion (3% more than in the same period in 2022), the Vehicle Services business — alongside the New Vehicles business of the TRATON brands — was an important factor in the development of the Company’s sales revenue. TRATON will play an active role in shaping transportation and logistics in the future. To do so, the Company intends to create new business models and partnerships that add value in a world marked by electrification, autonomous driving, and connectivity. The transition to e-mobility will have a positive impact on the TRATON GROUP’s Vehicle Services business. The established and technically well-equipped service network of the TRATON brands therefore opens up additional customer groups for complex repair and maintenance work. This also applies to new components such as battery systems. The service portfolio can also be expanded further to include additional services relating to areas like charging processes, battery recycling, and vehicle connectivity.

TRATON’s financial services business also performed very well in the first half of the year with adjusted operating return on sales remaining at a high level at 21.5%.

Strategic evolution of TRATON Financial Services

TRATON reached another important milestone in July with the signing of a framework agreement with Volkswagen Financial Services and Volkswagen Bank. The agreed acquisition of key aspects of the global MAN and VWTB Financial Services businesses is the next logical step in the development of TRATON Financial Services as the global captive and integrated financial service business unit of the TRATON GROUP.

The scope of the transaction includes the sale and transfer of rights to provide financial solutions to MAN and VWTB customers. To ensure a smooth transition, the business will be transferred on a country-by-country basis. This integration is expected to be completed by the second quarter of 2025. Bundling the Financial Services backbone for the Company’s commercial vehicle brands will allow TRATON to support their unit sales even better in the future.

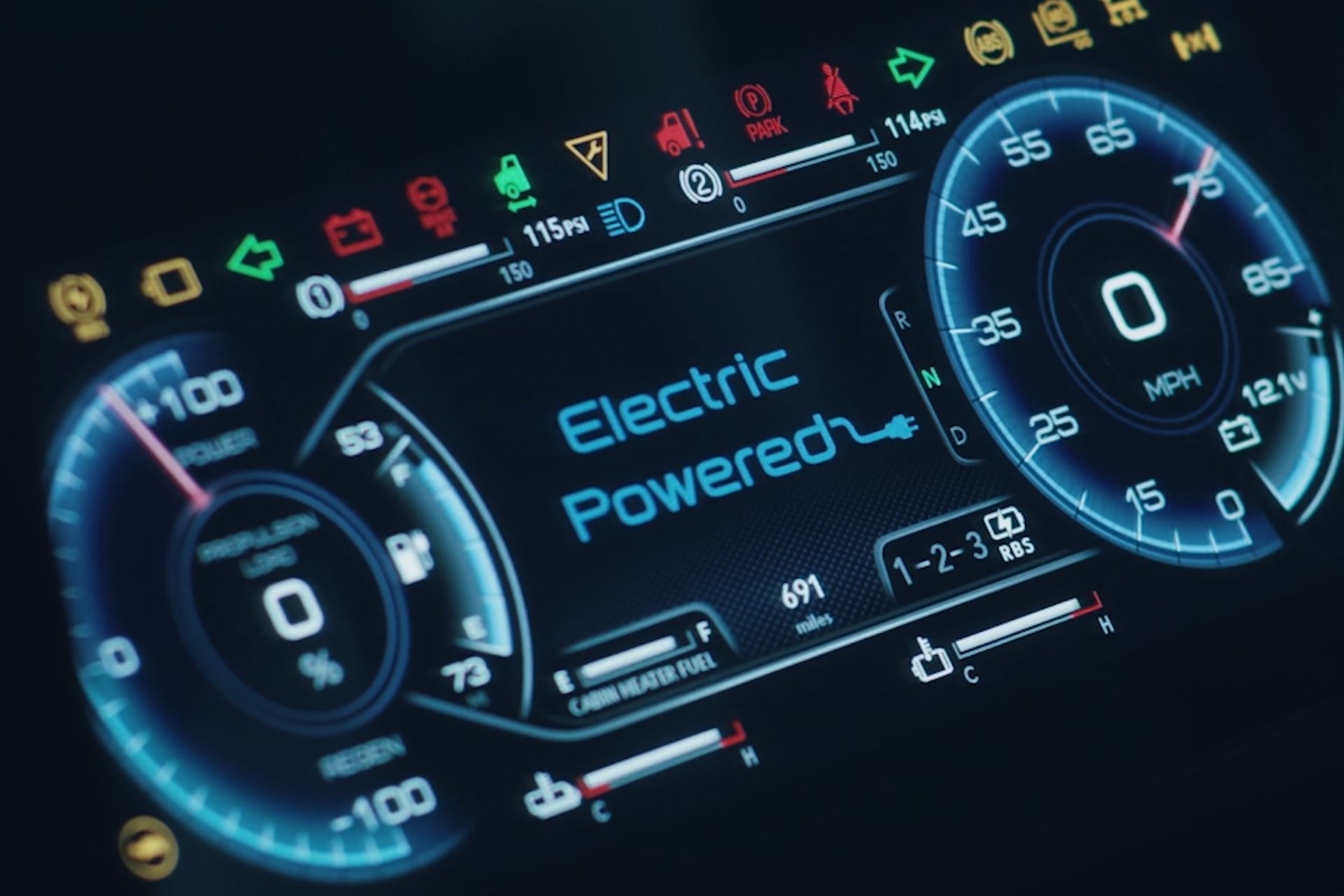

Important advances in electric mobility on the road to sustainable transportation

The Company has a clear roadmap for its electrified, connected, and automated commercial vehicles. The TRATON GROUP was able to make further progress in the field of electric mobility in the first half of 2023.

In April, Scania and Northvolt presented a jointly developed battery cell for electric heavy-duty commercial vehicles. In validation tests, this lithium-ion cell demonstrated the ability to power a truck for 1.5 million kilometers — equivalent to the vehicle’s entire service life. Produced with green electricity in northern Sweden, the cell’s carbon footprint is approximately one-third of that of comparable batteries in the industry. Later this year, Scania will follow the 2022 market launch of its battery electric truck for regional transport with the introduction of a long-haul truck. TRATON’s Swedish brand also recently undertook the first test to develop a Megawatt Charging System (MCS) in cooperation with ABB E-mobility.

MAN is also preparing to start series production of its battery electric long-haul truck in 2024. The company has already secured important customers, including Duvenbeck and DB Schenker, and received more than 500 pre-orders. Meanwhile, public transport company Verkehrsbetriebe Hamburg-Holstein GmbH has ordered up to 100 units of the Lion’s City 12 E bus to further advance the electrification of local public transport in Germany’s second largest city.

Within the past quarter, Navistar also announced the delivery of the first International® eMV™ Series with ePower to Sysco, a leading global food supplier. The companies will join forces to accelerate sustainability efforts in the Class 6 all-electric refrigerated truck segment and support Navistar’s emission reduction targets within the scope of the Science Based Targets initiative.

As the only manufacturer with a large-scale production of electric vehicles in Brazil, VWTB recently celebrated a milestone with the start of series production of its e-Delivery truck.

Positive outlook confirmed for fiscal year 2023

In light of its strong performance in the first half of the year, the TRATON GROUP is reiterating its forecast for fiscal year 2023 to the largest extent possible. The Company is also expecting the Group’s unit sales and sales revenue to increase by 5 to 15% each. In addition, TRATON expects adjusted operating return on sales in its TRATON Operations business area to range between 7.5 and 8.5% and is now projecting a range of 13.0 to 18.0% for its TRATON Financial Services business area.

Both the forecast range of 7 to 8% for the TRATON GROUP’s adjusted operating return on sales and the outlook of €1.8 to €2.3 billion for net cash flow in the TRATON Operations business area remain unchanged. However, the Company currently expects to close 2023 with both indicators at the upper end of their forecast range.

This positive forecast is attributable to higher production capacity utilization, which was already noticeable in the first half of 2023, as well as to increased vehicle deliveries and the associated decline in fixed costs in the TRATON Operations business area. Just like in the first half of 2023, the significantly higher prices for energy, raw materials, and other bought-in components will be offset in the second half of the year by introducing price measures.